YORK LINK BLOG SERIES

**ALL THREE PARTS OF THE THREE PART SERIES**

Following a year-long – and at times very public – process it was announced that Amazon’s HQ2 would be split between the transforming quasi-suburban neighborhoods of Long Island City, New York and Crystal City, Virginia. Both locations are urban growth areas that fall outside of traditional downtown areas that were highlighted in many of the public submissions in the bid competition.

Amazon received 238 bids from cities across North America, each vying to host the company’s second headquarters. Included was a collaborative bid from the Greater Toronto Area (GTA), which attracted significant global attention as one of the first bids to be made public. It received further attention in the media and business community when GTA’s bid was shortlisted into the Top 20 by the tech and e-tail giant.

This was an undisputed achievement for the Toronto area and a coming-of-age moment for its fast growing technology community. However, pending the release of additional details surrounding the final announcement, we may need to take a moment to reflect on Amazon’s location selection, beyond talk of tax breaks or HQ2’s housing or talent implications.

This moment of reflection begs the question:

Are we short-selling ourselves as it relates to potential locations where we collectively think major technology or head office investments should occur within the Greater Toronto Area?

Amazon’s surprising (or not) HQ2 locations of choice: two formerly quasi-suburban redevelopment communities

As we now know, Amazon has chosen not to setup HQ2 in Manhattan or Downtown DC. Rather the massive investments that are bringing a potential of 25,000 jobs respectively to each HQ2 office are in the outer area of two large metro area cores. Two places that are going through a quasi-suburban to-urban transformation, creating a hybrid mix of living styles.

The first is Long Island City. With a local population of 70,000 it is a fast growing neighbourhood in Queens: part of the New York metro area just across the East River from Midtown Manhattan. The area is redeveloping from “a nothing neighborhood with a semi-industrial mix of businesses and some residents,” according to CNBC, to a vibrant, primarily residential, high-rise growth community, and soon-to-be home of one half of Amazon HQ2.

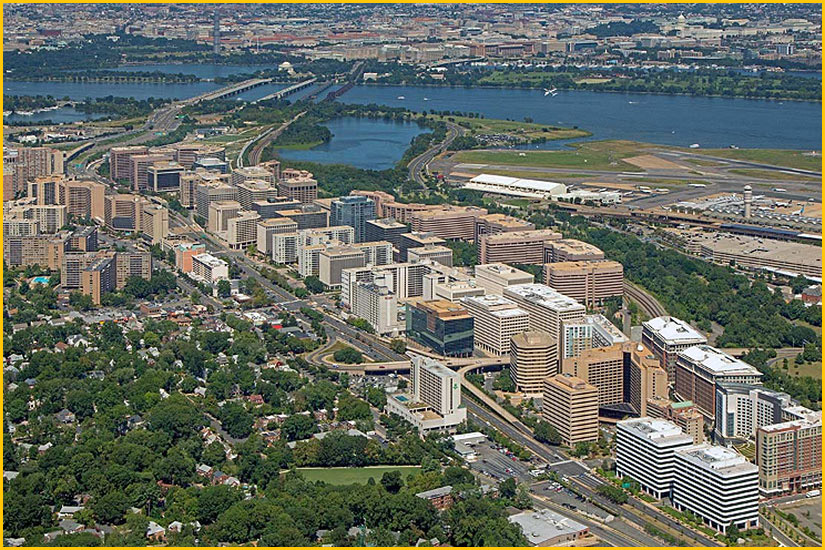

The second selection of Crystal City and its local population of 25,000 is a neighbourhood in Arlington County, Virginia; just south of downtown DC.

It’s characterized by the media as a “boring” location that is “the opposite of hip.” It is “populated by ’70s and ’80s-era office buildings” with a “sometimes empty streetscape” and “large swaths of vacant lands,” but also the soon-to-be home to the other of half of Amazon HQ2.

Many North American cities – the Greater Toronto Area included – pitched Amazon on hip and busy downtown districts that are home to brand names in tech, an energetic millennial workforce, and a vibrant brick-and-beam entrepreneurship start-up scene, alongside shiny glass corporate towers.

This brings us back around to the moment of reflection from earlier. Are we collectively doing enough in the GTA to promote and celebrate the tech hubs and urban transformation areas that exist throughout the entirety of the Greater Toronto Area?

URBAN GROWTH OUTSIDE OF DOWNTOWN CORES: SHOULD WE PAY MORE ATTENTION?

**PART TWO OF A THREE PART SERIES**

If you missed part one of this series, we looked at Amazon’s surprising selections for its HQ2 locations – quasi-suburban redevelopment neighborhoods – rather than a hip downtown environment in a big city that many of us expected the company to invest in.

We ended with an open question whether enough is done collectively in the GTA to celebrate and spotlight the urban transformation areas that exist throughout the entirety of the Greater Toronto Area.

Considering Amazon’s original bid criteria and its final selection for HQ2 there are a number of key locations across the GTA that should receive a lot more attention in terms of Canadian media coverage, business chatter, and formal promotion by various stakeholders across the GTA.

GTA’s collaborative bid for Amazon HQ2 included a number of proposed sites in Toronto’s downtown waterfront areas and provincially-recognized urban growth centres in Vaughan, Markham, and Mississauga, alongside a range of development lands from Brampton to Oakville to Pickering. These sites are listed beginning on page 114 in the Toronto Region’s bid.

Moreover, additional urban growth areas in the GTA that were not formally included in the bid, such as the Richmond Hill Centre and Toronto Downsview sites, are consistent with Amazon’s choices for HQ2 and could have met some (or most) of the key requirements.

Nonetheless, Canadian media coverage and public discussion in the context of Toronto’s Amazon HQ2 bid was focused almost exclusively on the downtown core as the natural and only reasonable location for Amazon’s HQ2 in the GTA. Public discussion on any of GTA’s other qualified urban growth sites noted above was barely existent and still is despite Amazon’s non-downtown-core choices.

So how significant are the GTA’s urban growth centres, and do they deserve increased attention, in light of where HQ2 ended up?

To answer this question we’ll provide context around the urban growth centres in Toronto area’s York Region, as that’s our area of expertise. Information related to other major urban growth centres across the GTA would likely paint a similar picture.

A dive into York Region’s urban growth centres

Traditionally known as a suburban community with spacious subdivisions of detached homes, York Region – particularly its southern and most populated area – has been transforming into an urban-suburban hybrid with a diverse housing mix and a significant share of the GTA’s economic activity.

For example, according to public data from BILD, over the last four years more than 20,000 new condo apartments were sold in York Region; second only to the City of Toronto and more than the rest of the GTA’s 905 Regions, combined!

Much of this new condo development is well underway in the communities of Markham Centre, Vaughan Metropolitan Centre (VMC), and Richmond Hill’s Yonge Street corridor.

Overall, York Region’s four designated urban growth centres (Newmarket is another growth-targeted community) are projected to accommodate 150,000 new residents and 110,000 jobs over the next 13 years: a meaningful share of the total 1.6 million residents and 790,000 jobs projected by 2031 for York Region as a whole.

These areas are seeing massive investments in transit and infrastructure by all levels of government, including the only TTC subway extension outside Toronto city limits (Line One to the VMC), all-day, two-way GO Train service and 36km of Bus Rapid Transit lanes.

Walkable amenities are also popping up in these areas to meet the needs of increased population densities. Additional transit projects, including the much-needed Yonge line subway extension to Richmond Hill, are also in various planning stages.

These growth centres not only attract new residents looking for a hybrid urban lifestyle but new businesses too. KPMG, PWC, Miller Thomson, Aviva Canada, Under Armour, Harley Davidson HQ, GFL, and Densify are just some of the employers that recently moved into York Region’s urban growth centres.

They are creating thousands of new jobs and adding to key businesses already established in these areas, like IBM’s research lab, Honeywell, Worley-Parsons, Mircom, Teledyne, and others. Other major companies are now choosing the periphery of York Region’s urban growth centres such as GM’s new 700-person software development centre in Markham, and Digital Realty, and Telecon in Vaughan.

Considering Amazon’s selection(s) for HQ2 it seems a lot more plausible now than a year ago that these different urban transformation area across the GTA need to receive a lot more attention and be promoted as viable locations for major tech and head office investments in knowledge-based sectors.

This is especially true in light of a new report published this week by Toronto’s Neptis Foundation pointing to ‘hyper-concentration’ of jobs in Toronto’s downtown as a risk factor for the entire region, and calls for a secondary transit-connected “downtown” in the GTA to ensure the metro area’s economic resilience.

That said, urban transformation alone is not enough to attract major greenfield technology or corporate investments like Amazon. A robust and established tech cluster is a critical component. So do GTA areas outside downtown Toronto have what it takes in this regard? We’ll explore this in the final part of the series.

TECH IN THE GTA: A ‘CLUSTER OF CLUSTERS’ THAT DESERVES UNPACKING, ATTENTION, AND PROMOTION

** PART THREE OF A THREE PART SERIES **

In Part One, we looked at Amazon’s surprising selection of quasi-suburban redevelopment neighborhoods for its HQ2 locations, and raised the question of whether in light of that the GTA’s own urban transformation areas are getting the exposure they deserve.

Part Two presented a deeper dive into the significance of the GTA’s urban growth centres outside of the downtown core. We ended with the open question of whether areas in and around these successful centres also have what it takes when it comes down to attracting investments in the tech sector.

Greater Toronto’s tech sector is more like a cluster of clusters rather than a single hub

As this recent map from Neptis Geoweb shows, while there is a concentration of tech sector jobs in downtown Toronto, those jobs are, in fact, spread out across the GTA, with the most significant clusters located in Toronto’s downtown core, Markham and Richmond Hill in York Region (specifically highways 404/407 node), and in Mississauga (airport area).

Some areas in the GTA are home to secondary clusters, like the City of Toronto’s North York district, while others such as York Region’s City of Vaughan have a growing and increasingly significant B2B tech cluster to keep a close eye on.

These clusters are unique and can be differentiated along such lines as industry verticals, B2C or B2B focus, talent type needs and catchment areas, real estate types, cost of operations, brand vs. non-brand corporations, transit/vehicle accessibility, etc.; this alone could easily be a topic for a separate blog.

To add more context around the significance of GTA’s secondary tech hubs, York Region’s tech sector, for example, comprises 4,300 Information & Communications Technology (ICT) companies [employers] as per StatsCan data, second only to the City of Toronto in Canada. This includes both global enterprise-scale tech giants as well as some of Canada’s leading B2B tech scale-ups [more on this here].

The Region is also home to the highest labor force concentration of tech occupations in the Toronto-Waterloo corridor with almost 9% of the total, and also pulls in tens of thousands of reverse-commuters from nearby municipalities (mostly professionals living north of the 401).

As the table on the right shows, on a national scale the GTA’s York Region (primarily Markham, Vaughan, and Richmond Hill) and Peel Region (Mississauga and Brampton) not only represent a compelling share of GTA’s 16,000+ ICT business establishments, but each has a larger tech sector then most other municipal census divisions in Canada – other than the neighbouring City of Toronto.

So why does it matter and what’s the connection to Amazon’s HQ2 location choices, in a GTA context?

So what’s the bottom line considering the above? That a ‘cluster of clusters’ tech sector in a metro area of over 6.5 million residents, 250,000 business establishments, and 16,000 tech companies really warrants unraveling. Despite this, tech sector reports, media coverage, and promotional sector value propositions here in the GTA focus almost exclusively on one single ecosystem in the Toronto downtown.

Many of the bids received by Amazon from across North America pitched hip, downtown districts, home to brand names in tech, an energetic millennial workforce, and a brick-and-beam start-up scene happily coexisting alongside shiny glass corporate towers.

Yet to the surprise of many, Amazon chose for its massive HQ2 investment the quasi-suburban transforming neighborhoods of Long Island City, NY and Crystal City, Virginia. On the other hand, Canadian media coverage on GTA’s Amazon bid focused almost entirely on the downtown/waterfront area as the only viable location for Amazon in Toronto, and largely ignored other GTA tech hubs and urban growth centres as viable locations for major tech and corporate investments.

So to bring it full circle, let’s jump back to the question from Part One that kick-started this series. In light of Amazon’s surprising HQ2 location selections are the GTA’s own urban transformation areas outside the downtown core and their surrounding tech hubs getting the exposure and attention they rightfully deserve?

We’ll let you be the judge of that, but hope this three-part blog provided some food for thought.

– By the York Link Team